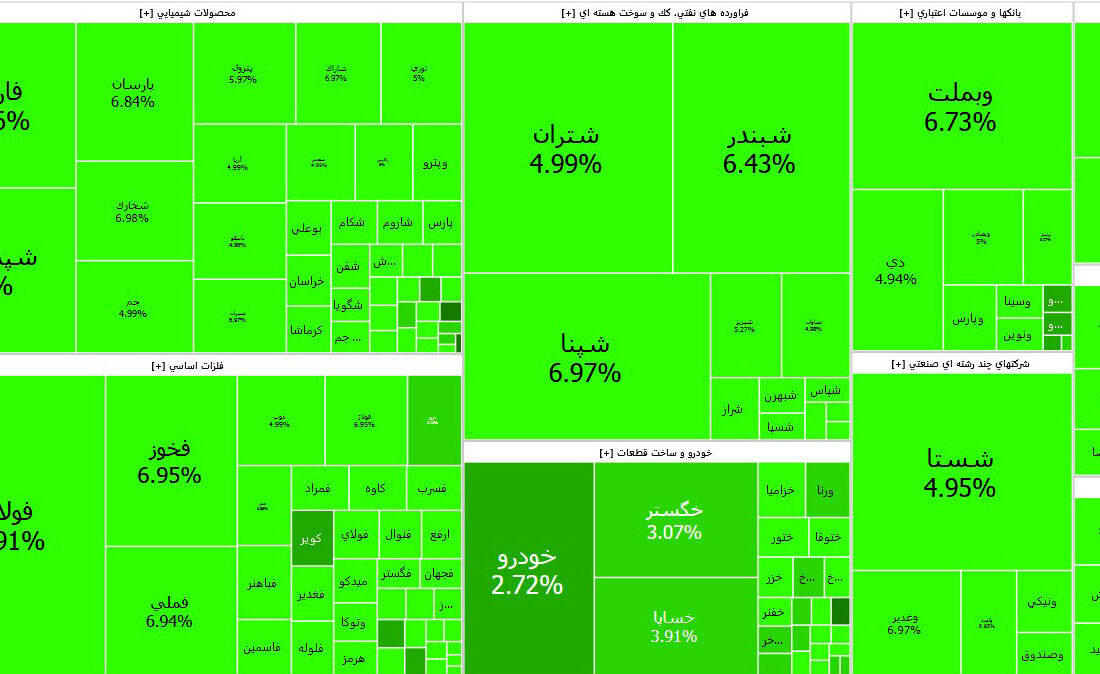

According to Rokna, yesterday’s stock market indices were associated with historical record breaking. With a growth of 4.96%, the total index experienced its third historical growth on a daily basis, and the Hemozen index also experienced its highest historical growth on a daily basis since the beginning of the calculation of this index. Indices and prices in the glass hall on Saturday uniformly put on green clothes, and the injection of money from the real people caused the overall stock market to grow tremendously with the strong support of the demand flow and the withdrawal of sellers in the trading cycle. In the past day, real people entered the stock market with 1,239 billion tomans. The Tehran Stock Exchange has been on an upward trend due to the increase in the price of the dollar, and considering the perspective of inflationary expectations and the lag of prices in the stock market compared to the price of foreign exchange and other parallel markets, the demand has returned to the borders of the glass hall. Now the key question is, is it possible to continue the upward movement of the stock market towards the historical peak?

Stock market towards the historical peak?

Yesterday, the Tehran Stock Exchange witnessed an endless series of record-breaking events in its trading scene, and the insatiable thirst of demand in the stock trading round caused numerous historical records to be set in most of the stock market indices. The green color of the market map became the guest of the stock market activists and the enchanted superchannel of 1.7 million units was recaptured with strength and the total index of the Tehran Stock Exchange reached its third historical growth above this psychologically important range. The Hemozen indicator calmed down by registering the highest growth in the daily scale around its historical ceiling. The undisputed winner of the battle of supply and demand was the buyers who, during the coercion with the sellers, did not allow this group of market players to show off so that the Tehran Stock Exchange experienced one of its most historic days.

Historical record breaking total index

The main thermometer of the stock market reached the level of 1,738,000 units in Saturday trading with an extraordinary growth of 82,000 units, which was equivalent to 4.96%. This is the third historical growth of the total index of the Tehran Stock Exchange since the beginning of its calculation. The highest percentage growth of the total index of the stock market was experienced on September 4, 2088, when the said index experienced a growth of 5.40%. Before that, the highest historical growth of the stock market was experienced on June 13, 1982, when the total index grew by 5.22%. The growth registered on the previous day was the third historical growth of the Tehran Stock Exchange on a daily basis.

Historical flight of isometric graph

The equal weight indicator, which is a sign of the equal effect of all market symbols and shows the overall market image well, reached the range of 525,663 units on Saturday by recording an increase of 4.46 percent. This percentage growth rate on a daily scale has been unprecedented since the beginning of the calculation of the balanced index in 1993. Prior to this, the equal weight indicator had managed to grow by more than 4% on a daily basis only 4 times in its history, which happened 3 times in 2019 and once in 2018. Previously, the highest daily growth of the mentioned index was recorded on May 13, 2019, when this index grew by 4.30%. A noteworthy point in the comparison of the mentioned figures is that even in the dreamy days of the Tehran Stock Exchange in 2019, the whole market was never accompanied by such a growth in the daily period, and the market experienced one of its most historic days the previous day. After the fall of 2019, Nemagar Hamozen tried its luck many times to reach its historical ceiling again, which always failed to achieve this goal, and the last case happened in late January of this year, when Nemagar Hamozen failed to continue its growth. reach the peak of 99 Now, however, the case is a little different, and the balanced index is only 8 thousand units away from its historical ceiling recorded in 2019, and it seems that in the coming days, with the support of the demand flow, it will cross this psychologically important range.

Continued thirst to buy stocks

The constant and continuous thirst of buying shares by real people in Saturday’s trading caused us to witness a record breaking and change of direction in this statistical variable as well.

In the past day, the net change of ownership from the legal portfolio to the real portfolio was 1,239 billion tomans. This amount of money injection by small shareholders has been unprecedented since 25th of February 2019. The continuous ceiling breaking of the American bill in the free market transactions, which has heated up the demand in other parallel markets, has also spread to the flow of stock transactions and has made stock market players more hopeful about the return of prosperity to the stock transactions. In yesterday’s transactions, the dollar industries of Tehran Stock Exchange were at the top of the list of industries that were met with the most success by real estate agents. The three industries of chemical products, basic metals, and multi-disciplinary industrial companies were the groups that witnessed the largest inflow of real money, and the three industries of mass production, real estate, machinery, and technical and engineering were also the three industries that recorded the largest outflow of real money. Also, in yesterday’s trading, 85% of the symbols finished their work in the positive circuit, and only 14% of the symbols finished their work in the negative domain, and 1% of the symbols were placed in the zero range of the board. Among the 39 industries of Tehran Stock Exchange, 25 industries completed their work with the inflow of real money and 14 industries with the outflow of real money. The value of small transactions also recorded 6,374 billion tomans, separating itself from the lower figures of 5,000 billion tomans experienced at the end of February, and from the side of this statistical parameter, which well conveys the state of stagnation and prosperity in the stock market, signals A positive is being issued.

Isfand, the sound of spring?

By registering the previous day’s performance in the overall index, March became the best month of Tehran Stock Exchange in 1401. In the current year, the main indexer of the glass hall managed to register a return of more than 10% in just two months. In April, this index experienced a growth of 10.6% and January was the best month of the stock market in terms of monthly growth with a growth of 12.9%, but the engine of prices in the stock market suddenly turned on in March and in only 4 trading days in In March, the total index of the Tehran Stock Exchange increased by 13.4%, so that by recording this increase, March became the golden month of the stock market this year.

The interesting thing to note in March transactions was the recording of 3.97, 4.09 and 4.96 percent growth in the total index in one trading week.

Recovering the enchanted super channel

After the historical fall of 2099, the total index of the Tehran Stock Exchange repeatedly determined to conquer higher peaks, but each time the total index stopped behind the psychological border of one million and 700 thousand units, and somehow this range had become a spell for the said index. The last time when the main indicator of Glass Hall was located in the above channel, it was on September 26, 2019, and now after 30 months, the total index has again reached the top of this psychologically important range, and it should be seen that the continuation of the price jump in Glass Hall has brought the total index to Will it lead to higher altitudes or not?

Resonance of the dollar in the market

Observing the movements of the stock market players in the past day shows that the dollar industries have faced the most luck from the buyers. It seems that the cycle of money transfer among the industries of Tehran Stock Exchange is going on and after some time when the dollar industries were associated with the outflow of money and the smaller industries of the market were associated with the outflow of money, now this process has been reversed and due to the increase in the price of American bills which in the profitability of stocks Dollar plays a significant role, this group of shares has been welcomed by Tehran Stock Exchange activists, and money is being transferred from smaller market industries to large market industries.

It is worth mentioning that last day, a large amount of money in the ranks of buying unsold dollar stocks failed to buy the desired stocks.

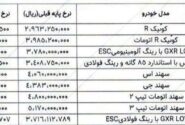

Shares in thought and business to compensate for backwardness

Most of the parallel markets have seen price jumps and unbridled growth in the current year. In the current year, the dollar has grown by 110% and the Imami coin has grown by 167%. The only market that remained abandoned among the domestic financial markets of the country in 1401 is the stock market. By examining the indices of the stock market in the long term with the indices of other parallel markets as well as the price of the dollar, we find that the stock market has been the best domestic market in the country for investment in terms of yield in the long term, although it is possible that in the short term, the stock market may fail due to various reasons. It takes a neutral and inverse path in comparison with the movement of other parallel markets, but in the long term, the stock always compensates for this price lag and sometimes even earns excess returns in addition to the returns recorded in other markets. In the current year, the stock market had the fundamental conditions of value in many industries and symbols in its heart, but the factors that have been discussed many times in previous reports prevented the stock market from being on the same path as other markets. One of the most important factors that caused the Tehran Stock Exchange to ignore the price growth of the open market dollar was the stability of the dollar rate in the range of 28 thousand and 500 tomans. Recently, according to the actions taken and the news that is heard from all corners in the direction of the exit of companies from the shadow of the half-dollar, the market has welcomed this, fueling the price rise, especially in the dollar-denominated industries.

In addition to this factor, the issue of car supply in the commodity exchange, trading restrictions such as the fluctuating domain, non-expert speeches about the stock market, the decisions made by the country’s leaders and economic trustees, the 1402 budget and the issue of petrochemicals feed, the attractiveness of other parallel markets due to the lack of government restrictions was one of the most important factors that It caused the stock market to not be able to grow in line with the general inflation of the country and the price of the dollar and other parallel markets. As mentioned in the March 2nd report as the beginning of the upward trend of the stock market, the Tehran Stock Exchange has proven itself in the history of its transactions in previous years, even with the shadow of various risks on the stock trading scene, the variables of inflationary expectations and the price of the dollar and the existence of an atmosphere of uncertainty. At the macroeconomic level, it gives considerable weight in its decision-making to determine the future situation and the direction of its movement. A concrete example of this claim occurred in the transactions of the Tehran Stock Exchange in late 1998 and early 2019. Despite the heavy shadow of the corona epidemic, the stock market

At that time, Tehran’s commodity-oriented did not give weight to any of the mentioned events, and the Iranian stock market at that time, riding on the wings of money injected by real investors and retail investors, continued to move in an upward direction. Considering that the unofficial dollar price continues to advance in the channel of 50 thousand tomans and inflation expectations are at their highest level, and also due to the fact that price bubbles can be clearly traced in other markets, most of the shareholders are focusing their attention on the rise of this variable. and reduced the weight of other risks in their calculations.

Stock future scenarios

Anyway, what the indicators and indicators convey about the trading situation of the glass hall is that the Tehran Stock Exchange is determined to compensate for the price lag and align with other markets and inflation and the dollar, and if the natural flow of demand faces obstacles such as the risks of If not, it will still raise the prices in the glass hall. Also, from a psychological point of view, the market is in a good condition, and the 1.7 million unit superchannel has been conquered after a long time, and the balanced index will probably break its historical ceiling soon. The dollar, as one of the most important drivers of rising prices in the stock market, continues to soar, but with that being said, due to the bitter experience of the historical fall in 2019, the trust of real people has not yet fully returned to the market, and due to the existence of a self-made limitation called the volatile domain. which creates the phenomenon of queuing in the market, retail shareholders still have the negative mentality of the 2019 stock market in the corner of their minds, and overcoming the current situation requires practical actions by the policy maker in order to restore trust in the stock market as a productive market.

From a technical point of view, there are three scenarios for the future trend of the main indicator of the glass hall. First, the current position of the total index is at the 60% fibo, which has broken this resistance level with strength. This issue in the stock market with regard to other parameters of net change of ownership, the value of small transactions of the stock market and also the volume of transactions indicates an increase in demand. It should be noted that the current level of the index (one million and 738 thousand units) has reached the resistance level that the market reacted to on 29 September 2019, and if the volume of transactions is maintained at high levels during the coming days of the current trading week, and the market will recover with the arrival of real money and assuming that the changes in the dollar rate are constant at the current levels (regardless of the fall in the dollar price), we can hope that the speed of changes in the growth of the total index will be the same as the last few upward days and will return to its previous peak levels, but on the other hand, We can see a scenario that according to the retrospective behavior of the main stock market thermometer, it can be said that after a strong growth in the same period, it will move with a gentle slope until the end of the year, on the other hand, the worst case is that considering that the volume of transactions It is high and the market cycle has enjoyed a recurring cycle during this period, it can be predicted that the total index will witness a pullback from mid-March onwards. In other words, the market should stop growing rapidly and the volume of transactions will be relatively low, and the index should retreat to its closest support level, i.e., the range of one million and 590 thousand units.

Source: World Economy